Insurance Chatbot Use Cases: How AI Reshapes the Industry

Home » Insurance Chatbot Use Cases: How AI Reshapes the Industry

Bad news: attention spans are toast. If a customer has to wait more than a minute to get a quote, file a claim, or ask a basic question, they’re already eyeing your competitor. People want 24/7 access, zero hassle, and support that feels tailored to them specifically.

Good news? 74% don’t mind if it’s AI or a human, as long as they get help fast. No wonder the insurance chatbot market is on track to hit $2.45 billion by 2029.

Forward-thinking insurers looking to stay competitive are using chatbots to cut costs, boost agent productivity, and level up the customer experience. Let’s dive into the insurance chatbot use cases driving that shift—and the tech behind them.

What are insurance chatbots?

Insurance chatbots are virtual assistants that handle real-time conversations with clients, so your human agents don’t have to jump in for every basic customer interaction.

Built on chatbot technology, they’re designed to help insurers streamline communication and automate repetitive tasks like policy updates or simple insurance claims tracking.

Whether it’s through a website chatbot integration, via app, or messaging platform, these digital tools improve customer experience while freeing up your team to focus on complex issues.

Types of insurance bots

Insurance chatbots may all look similar on the surface, but under the hood, they’re built very differently. They operate differently, and the value they bring to the table isn’t the same either. Based on the technology used, it’s possible to differentiate between two main types of insurance chatbots: rule-based chatbots and AI-driven tools.

- Rule based chatbots follow predefined scripts and decision trees. They’re handy for simple insurance chatbot use cases like answering common questions and handling straightforward scenarios, but they hit a wall when customer queries go off-script.

- AI-driven tools use natural language processing and sentiment analysis to understand context, read tone, and personalize responses. Unlike static bots, Conversational AI Solutions for insurance companies learn from past interactions and get smarter over time—meaning they can effectively deal with more nuanced conversations.

Why chatbots are essential in the insurance industry

The insurance industry runs on precision, speed, and scale. But juggling claims, policy updates, customer queries, and compliance—often all at once—isn’t exactly light work.

Digital assistants change the game. Chatbots use automation to take the weight off your team while giving customers faster, more satisfying experiences.

Let’s take a closer look at the advantages of chatbots for both insurers and their clients.

Benefits of chatbots for insurers

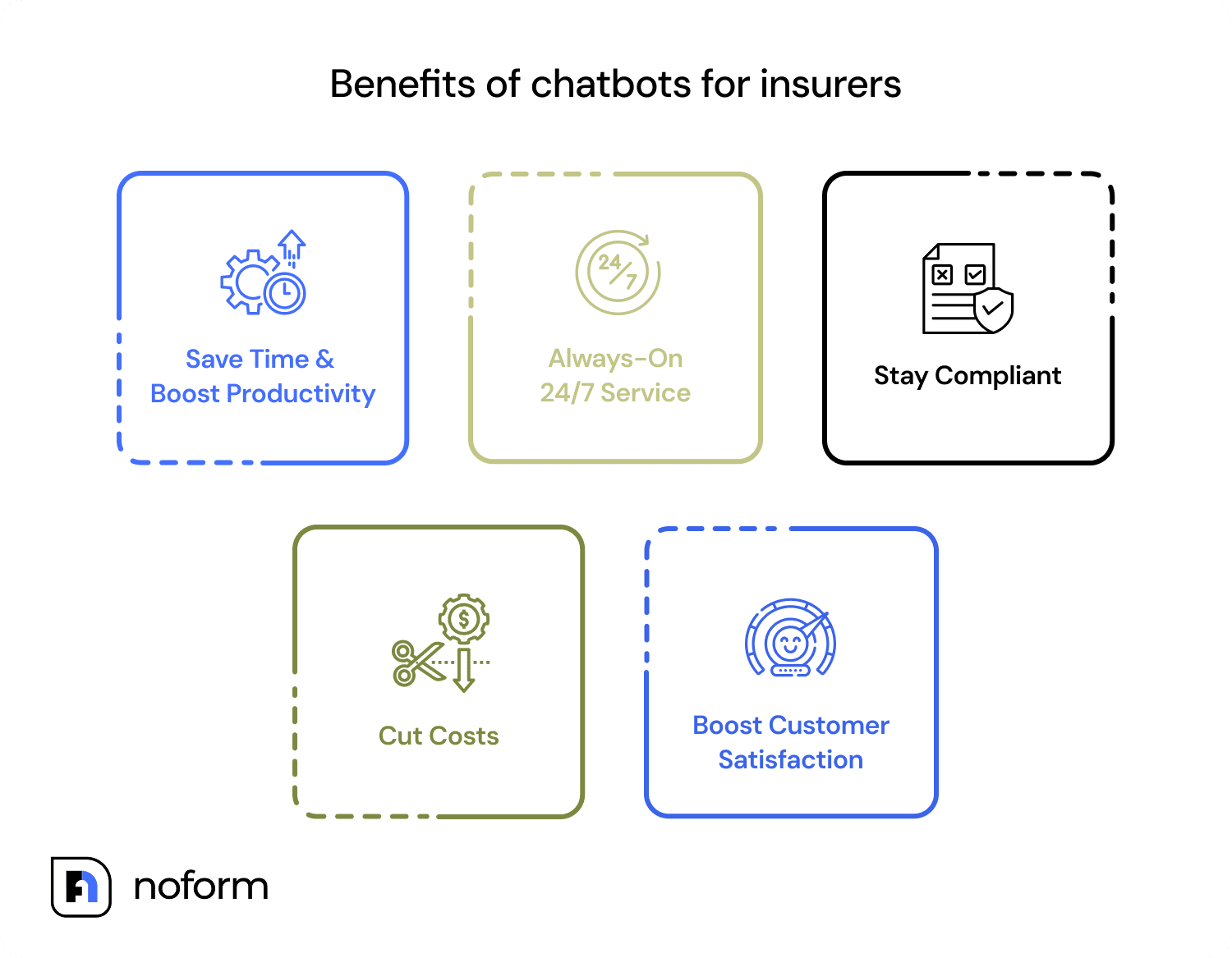

Via numerous chatbot use cases insurance businesses can win on cost, efficiency, and customer loyalty—here’s how:

- Increase agent productivity by offloading routine tasks: Chatbots handle high-volume tasks like checking policy status, updating personal details, and answering FAQs. That frees up your team to focus on business-critical work—upselling, renewals, and resolving complex insurance claim issues—saving hours of agent time in the process.

- Stand out with a 24/7 service that closes more deals: Customers don’t care about your business hours—they care about getting answers when they need them. Chatbots keep your insurance business responsive around the clock, helping you capture leads, process claims, and win trust while competitors are offline.

- Ensure compliance through guided interactions: Especially for regulated insurance sector processes, bots can walk customers through steps using approved language, minimizing compliance risk during real-time customer interaction.

- Reduce customer service costs: One bot can handle the workload of dozens of agents, responding to as much as 80% of routine inquiries. According to a report by IBM, chatbots use can slash customer service expenses by up to 30%. (Use our ROI calculator to see how much your business could save with different chatbot use cases in insurance)

- Improve customer satisfaction and build stronger relationships with clients: Insurance chatbots use real-time data to deliver fast, accurate answers, resolving 90% of queries in just 11 messages on average. With 61% of failed support calls linked to poor data access, that’s a serious edge—leading to higher satisfaction, more renewals, higher spending over time, and an increased chance of referrals.

Benefits of chatbots for insurance business customers

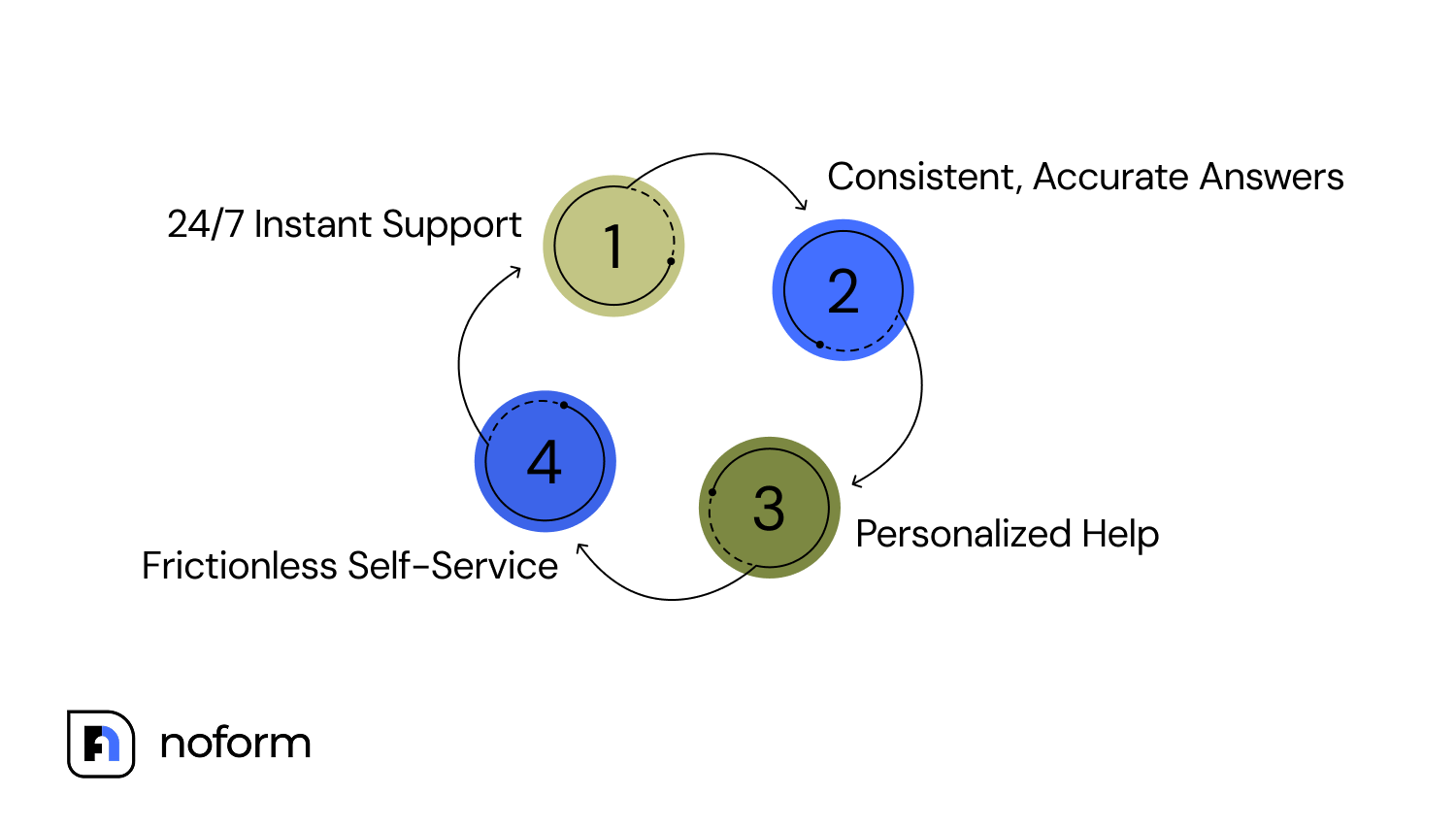

Chatbots are valuable to insurers, but they also improve the overall customer experience. With access to virtual assistants, customers can:

- Expect faster support, any time of day or night: Insurance emergencies don’t wait until Monday morning—and your customers shouldn’t have to either. Whether they need help with coverage limits, lost access to their dashboard, or have a middle-of-the-night claim question, an insurance chatbot offers immediate answers without hold times or ticket delays.

- Get clear, accurate answers: Avoid common customer service pitfalls like forgotten policies, inexperienced agents, or contradictory advice. Chatbots use your knowledge base to give consistent, complete, and up-to-date answers, resulting in faster time-to-resolution.

- Enjoy personalized, frictionless communication: Whether recommending the right health insurance plan or submitting claim photos linked to a license plate, AI-driven bots reference customer data like history, behavior, and location to offer tailored support.

- Simplify experiences: Forget logging into a portal, waiting on hold, or paying additional insurance company visits. Chatbots provide engaging self-service options that let customers handle everything on their own time.

Insurance chatbot use cases

With numerous chatbot features available, these tools support a wide range of insurance chatbot use cases. Let’s explore the most popular chatbot use cases in insurance—from customer engagement to internal team support.

Lead generation and qualification

The variety of insurance products—from health to auto to travel—makes static lead forms a poor fit. Each plan requires different questions, but cramming them into one form either waters everything down or turns into a lengthy mess that drives prospects away.

Insurance chatbots, on the other hand, adapt in real time, ask only what’s relevant, and instantly qualify leads as the conversation unfolds. With 36% of companies now using chatbots for lead generation, and 55% of those reporting better-quality leads, it’s one of the most effective chatbot use cases in insurance.

Tip: Connect NoForm AI chatbots with the CRM software you use (anything from HubSpot, telecrm, to InsureCRM) via Zapier to sync data between the tools.

Quote generation and instant policy guidance

Customers expect more than generic policy pitches. Nearly 9 out of 10 want insurance that feels tailored to their needs, and 67% prefer getting quotes through chat instead of filling out another form.

Even if you publish transparent pricing on your site, it’s not always enough. The SEO-friendly insurance jargon you’re using can confuse potential buyers. Many don’t know exactly what accident coverage they need, what’s available, or what they might be missing—which leads to hesitation, underestimated costs, or skipped essentials.

Fast, clear, and built around how customers actually shop for insurance, chatbots fix that. They use natural language processing and customer data to recommend the right coverage, explain options in plain language, and help users compare plans clearly.

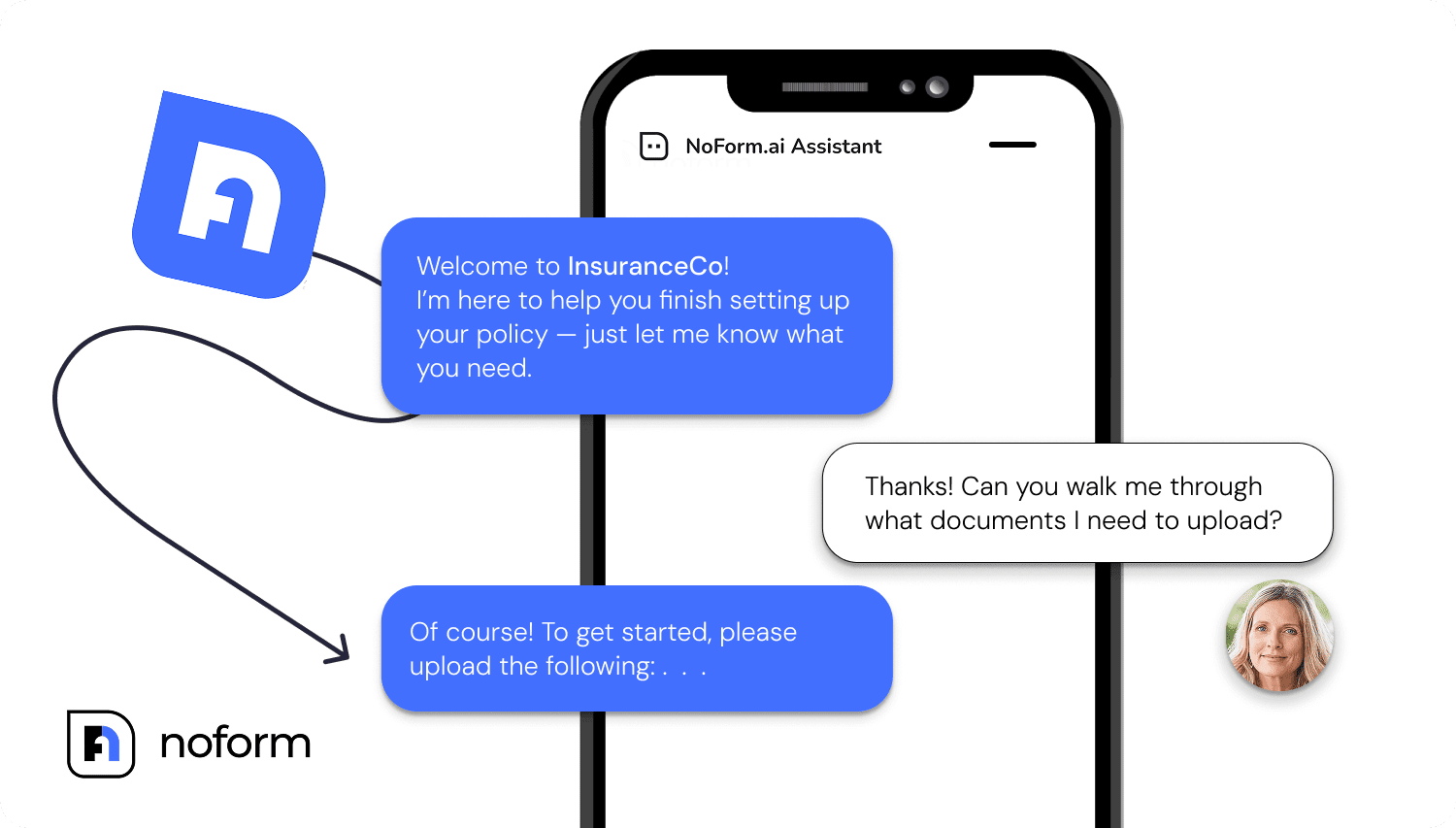

Customer onboarding

Capturing leads is just the start. Another high-impact chatbot use case in insurance is onboarding new customers. Chatbots smooth the handoff from sales to activation, guiding new customers through account setup, required documents, and FAQs.

By offering instant responses to common onboarding questions, bots reduce drop-off, minimize email back-and-forth, and help you start the customer journey on the right foot.

Claims process assistance and fraud detection

Filing a claim usually means something’s gone wrong—an accident, damage, a stressful moment. Customers are overwhelmed, and a confusing form only makes it worse.

Chatbots make the process easier. From the very First Notice of Loss, they guide users step by step: upload a photo here, attach a document there, no details missed.

Behind the scenes, the AI-based detection system scans for anything suspicious before the claim even reaches your team—a big deal when P&C insurers lose $45 billion annually to fraudulent activity. Easier for the customer, safer for your business.

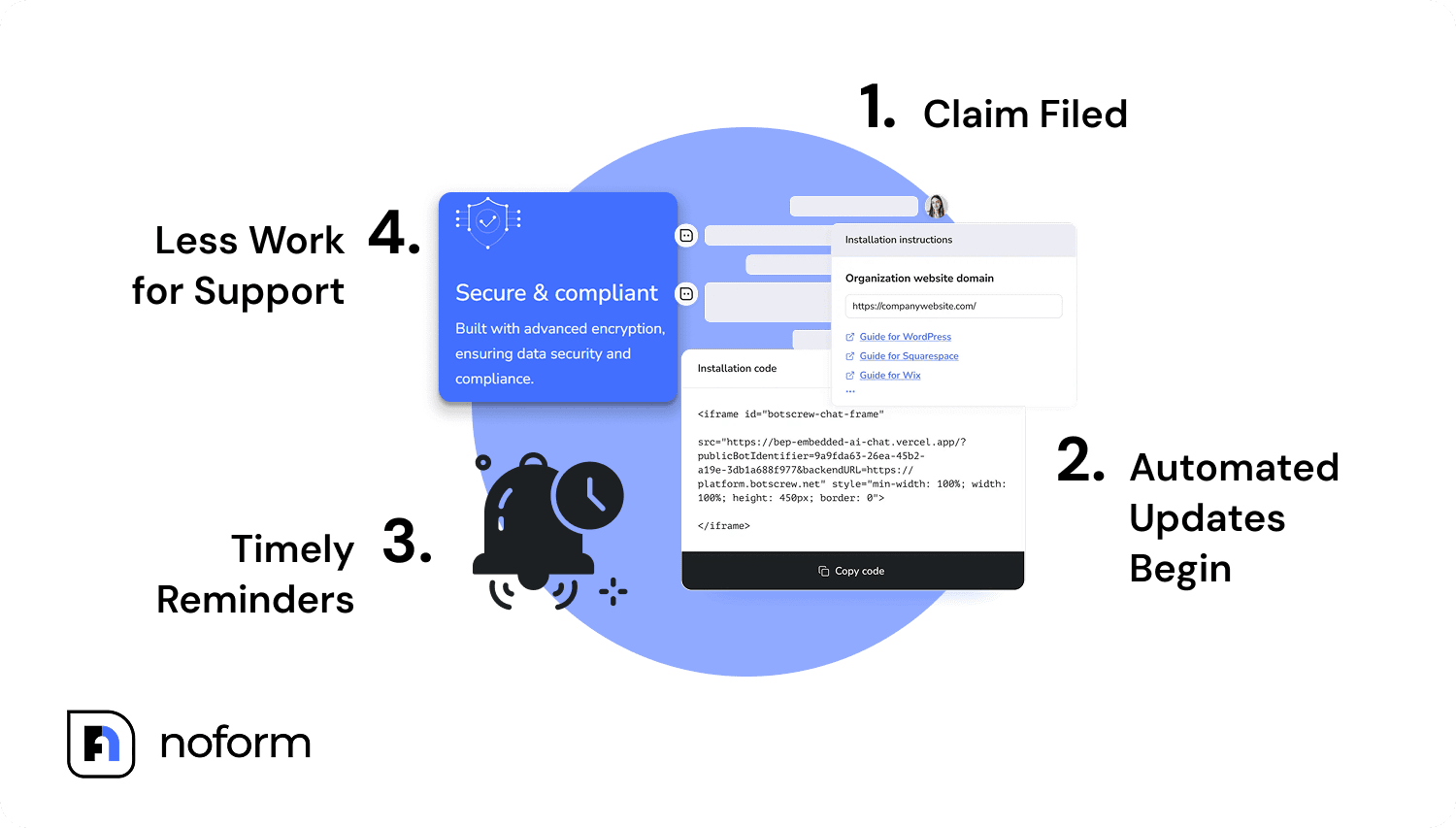

Claims status notifications & policy renewals, reminders

Once a claim is filed, the next question is always the same: “What’s happening with it?” After walking customers through the process, chatbots don’t disappear—they keep working.

They automate status updates, renewal reminders, and premium alerts, so customers aren’t left wondering or chasing information. It’s a simple way to improve communication, reduce missed payments, and ease the load on your support team.

Speaking of customer support…

24/7 customer support

Customer support remains one of the top chatbot use cases in insurance—and demand is only rising. By 2029, AI is expected to handle 80% of common service issues across the industry.

That’s no surprise, though. Nearly 60% of customers say long hold times are the most frustrating part of any support interaction. Expectations are clear: responses in under a minute on live chat, five hours on social, and 12 hours by email. Fall short, and you risk losing them to someone faster.

Chatbots help insurers meet those expectations, delivering fast, reliable support even outside regular business hours. And the reward? Well worth it.

With NoForm AI’s 24/7 support, companies like Dog Gone Taxi saw real results. By simply being available when competitors weren’t, they boosted lead generation by 37%. As their team put it:

“The fact that a customer can come in and get their questions answered 24/7 is highly critical, especially compared to just reading website information or filling out a form.”

Localized and multilingual support

Beyond being fast, great support is also understood. After all, if your customer speaks Spanish, French, or Hindi, your insurance chatbot should too.

Multilingual and localized support is one of the most underrated insurance chatbot use cases, yet it’s a game-changer for both customer experience and business growth.

NoForm AI’s bots handle dozens of languages and regional nuances, helping insurers scale into new markets without the cost of hiring full support teams.

Personalized cross-selling & upselling

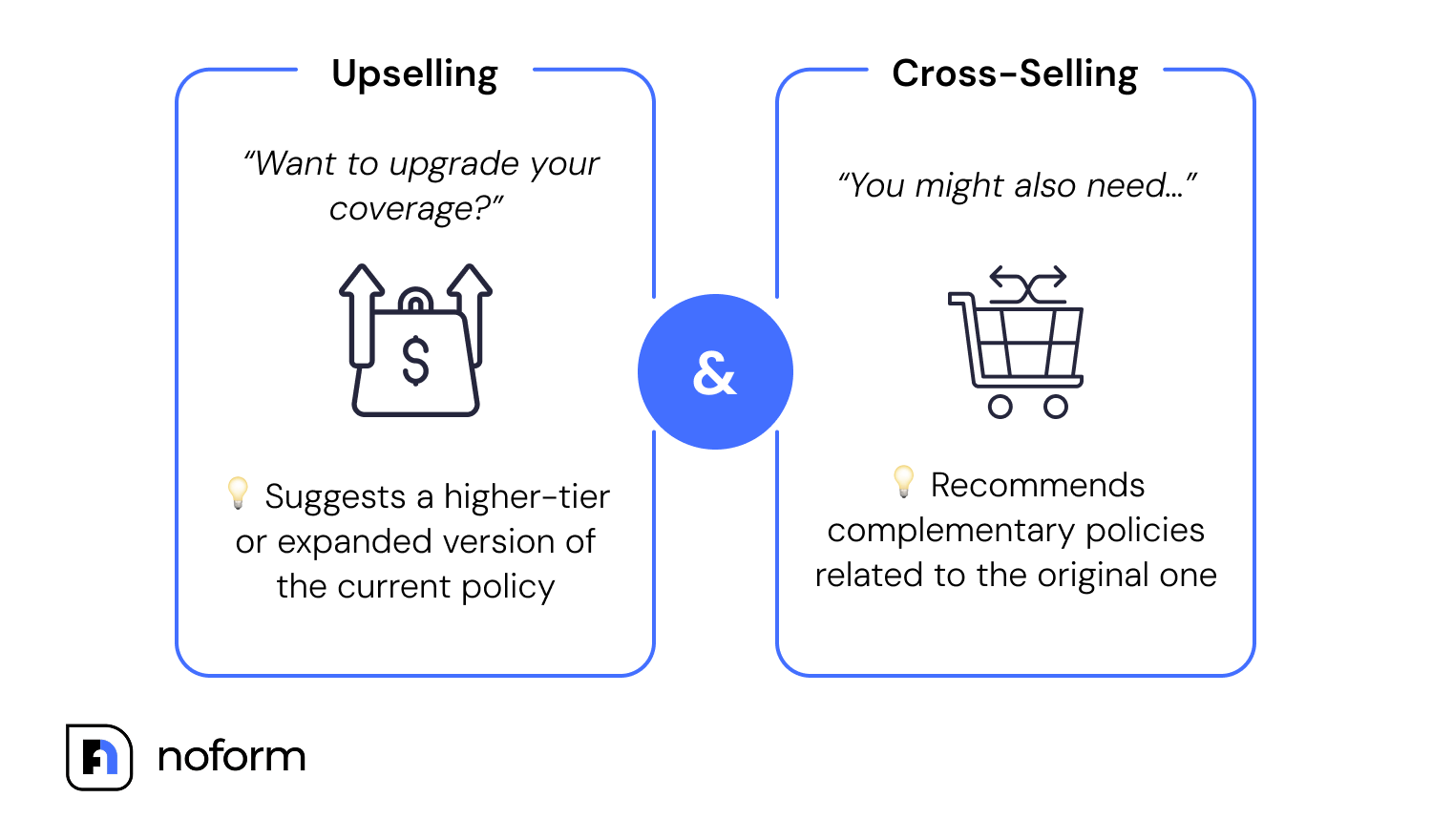

Expanding into new markets boosts reach—and revenue, yes. But it’s not the only way to grow your business. Another proven insurance chatbot use case is cross-selling and upselling to customers you already have. It’s actually the most common type of chatbot, with 20% of businesses currently implementing them.

In insurance, that might mean recommending roadside assistance during an auto policy inquiry, offering dental add-ons when someone reviews their health coverage, or suggesting travel insurance while a customer finalizes a life policy.

Chatbots use behavior, policy data, and timing to surface relevant offers in the flow of conversation. It’s no surprise upselling chatbots are the most common type, with 20% of businesses already using them to increase revenue without increasing overhead.

Regulatory compliance updates

In a heavily regulated industry like insurance,missing a deadline or update can be costly. Chatbots help you stay ahead by automatically sharing updates on policy changes, document requirements, or regulatory shifts. It’s a simple, proactive way to support compliance while keeping communication clear and consistent.

Complex issue routing to human agents

Even the smartest chatbot hits a wall sometimes—especially when a conversation moves beyond routine requests into complex insurance operations.

When that happens, the best systems like NoForm AI capture the full context (user details and chat history included) and log it in the dashboard. A human agent then reviews the information and follows up, typically by phone or email, depending on what the user shared.

It preserves the overall customer experience, prevents frustration, and saves hours of agent time otherwise spent retracing the same issue from scratch.

Agent support chatbots

Routing customers to agents is a common insurance chatbot use case. But sometimes, it works the other way around. Chatbots can also support the agents themselves.

As digital assistants, they help with internal knowledge base lookups, document management, and quick access to policy info—speeding up response times and cutting down on training for new hires.

It’s one of the more underrated chatbot use cases in insurance, but a powerful one for improving efficiency in your team’s day-to-day operations.

Why NoForm AI chatbot is the best solution for insurance companies

The future of chatbot use cases in insurance is already here (and it goes far beyond handling routine requests). From lead gen and onboarding to policy guidance and complex insurance operations, today’s best chatbots personalize the entire customer journey while streamlining internal workflows.

For insurers, that means faster service, lower overheads, and a real competitive edge.

NoForm AI delivers on all fronts. Ideal for the unique challenges of the insurance industry, our platform combines powerful automation with real-time adaptability, multilingual support, seamless CRM integrations, and more—all without the bloated setup or rigid templates.

Whether you’re ready to scale globally, boost retention, or simply make support smarter, NoForm AI is the all-in-one conversational AI solution built to move insurance forward.

Ready to see it in action? Start your free 7-day trial or book a demo and let’s talk about what you’re building.