Conversational AI for Insurance Companies

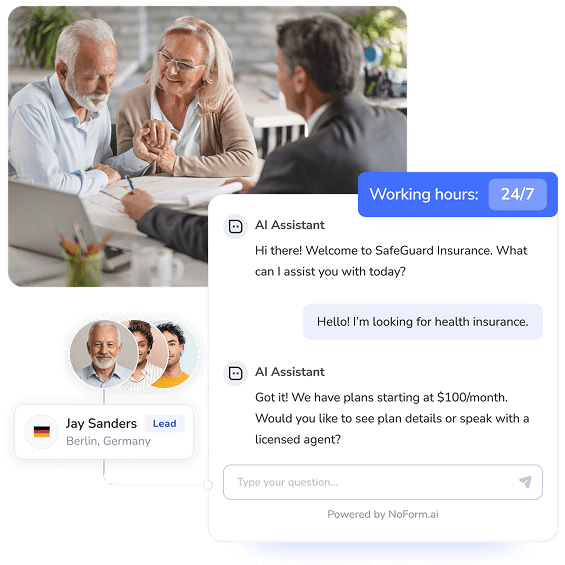

Turn website visitors into qualified insurance leads with a NoForm AI-powered chatbot. Provide exceptional customer service 24/7 and drive business growth.

Enter your website link to create your AI chatbot in just 1 minute!

Get more leads & close deals with conversational AI-powered insurance chatbots

Engage visitors in real-time and answer insurance questions around the clock with a powerful AI assistant for your website. Using conversational AI technology, streamline operations, simplify the claims process, and boost customer satisfaction.

Offer 24/7 support & instant answers

78% of customers choose the company that responds first. Don't let slow responses cost you sales. NoForm AI chatbot can be your virtual insurance agent, available 24/7 to answer basic insurance questions, deliver personalized experiences, and capture lead information instantly, enhancing customer self-service.

Qualify leads faster with conversation

Don't lose customers to lengthy forms! NoForm AI chatbots engage visitors in natural, human-like conversations, gathering key details like coverage needs, health history, or driving habits. This lets you qualify leads while they chat, saving you time and effort. Now, you can focus on what matters most—closing deals!

Increase customer satisfaction and keep them coming back

NoForm AI insurance chatbots can answer FAQs about coverage, deductibles, and claims–24/7. This provides instant pre-sales support, simplifies the customer experience, and frees up insurance agents for more complex issues. Satisfied customers are more likely to renew their policies and recommend your insurance company to others.

Boost efficiency & reduce costs

NoForm AI automates repetitive tasks like answering common insurance questions and troubleshooting minor issues. This frees up your team to focus on building customer relationships, providing personalized advice, and closing more sales. The result? Reduced operating costs for you and a more efficient, customer-focused team.

Lead targeted communication & gain valuable insights

NoForm AI chatbots for insurance companies engage visitors in real-time conversations, pinpointing their specific coverage needs, risk factors, and budget. This lets you deliver personalized quotes and target the right insurance plans, driving sales by leveraging customer interactions and policyholder insights.

Turn your website into a non-stop insurance lead generator

Automatically qualify the best insurance leads, personalize service offers, and run targeted marketing campaigns right within your chatbots. Engage visitors with insurance info, promote specific plans, nurture leads, and launch chatbots on landing pages to convert website traffic into happy policyholders.

Give your customers the instant conversational support they deserve!

Answer policy questions, guide them through claim fillings, and personalize quotes—all within the chatbot. Boost efficiency and close more deals with NoForm AI, the no-code AI chatbot builder!

What Our Customers Say

We were truly stunned at the ease of engagement, setup up, and implementation – in just a few minutes (literally), I had an operational bot on our website, with specifically trained AI that supported qualifying conversations about our business and full integration with a 3rd party scheduling system so people could book a demo with someone on the team. I’m very excited to measure the impact of this on our business as we move forward.

Applied Intelligence Agency

CEO

The fact that a customer can come in and get their questions answered 24/7 is highly critical, especially compared to just reading website information or filling out a form. As an international business dealing with clients all over the world, this accessibility is essential.

Rebecca Henning

We were truly stunned at the ease of engagement, setup up, and implementation – in just a few minutes (literally), I had an operational bot on our website, with specifically trained AI that supported qualifying conversations about our business and full integration with a 3rd party scheduling system so people could book a demo with someone on the team. I’m very excited to measure the impact of this on our business as we move forward.

Applied Intelligence Agency

CEO

The fact that a customer can come in and get their questions answered 24/7 is highly critical, especially compared to just reading website information or filling out a form. As an international business dealing with clients all over the world, this accessibility is essential.

Rebecca Henning

Why NoForm AI is the perfect

chatbot system for your

insurance business!

capture, nurture every customer interaction, and help your insurance business thrive by

implementing conversational AI solutions!

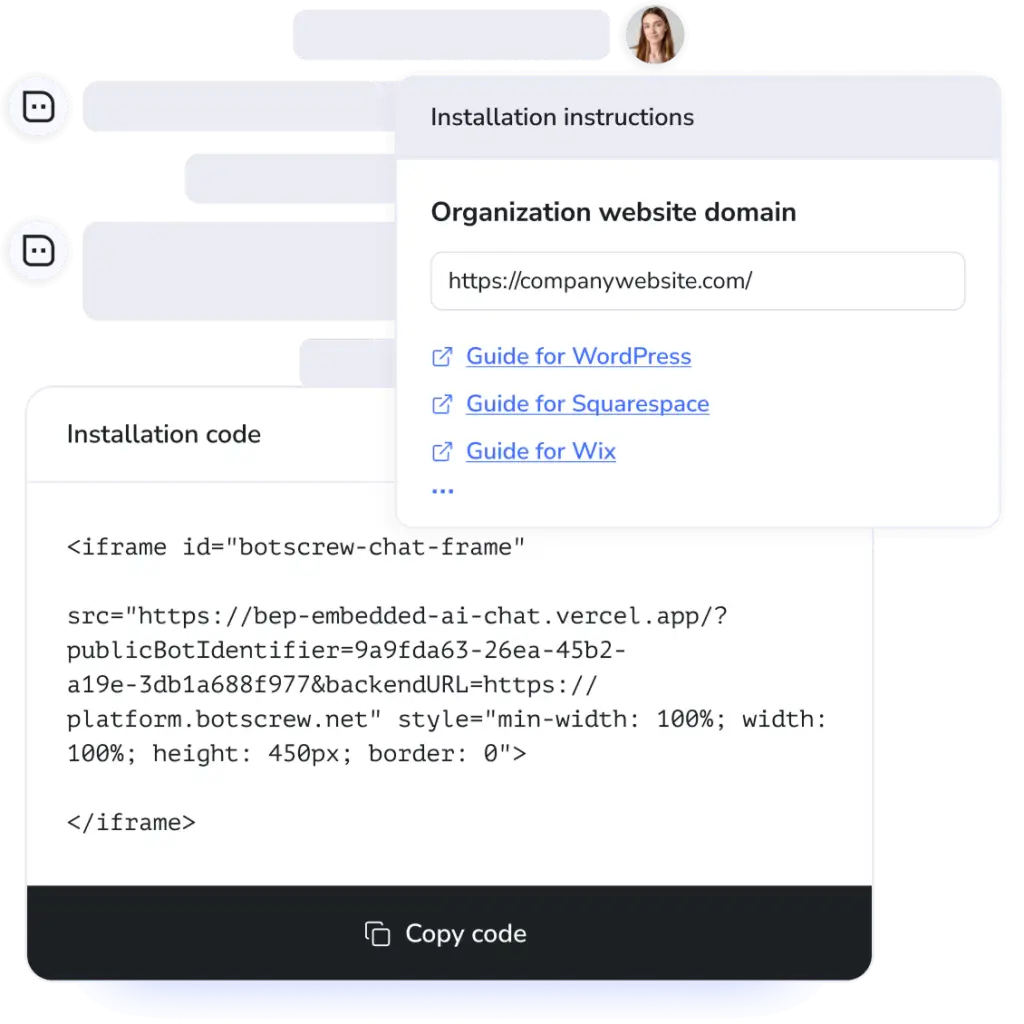

Easy setup & use

NoForm AI’s user-friendly platform makes creating a chatbot a breeze, even for those without coding skills. Setup takes minutes—simply copy and paste an embed code, and your chatbot will be ready to capture & qualify leads and answer insurance questions 24/7.

Seamless integration

NoForm AI integrates perfectly with popular platforms like WordPress, Wix, Squarespace, and more. This means a smooth workflow for you and your website visitors.

Fully customizable

Brand your chatbot to match your insurance company’s image perfectly. This builds trust and ensures a consistent experience for website visitors, fostering a positive first impression of your insurance services.

AI-powered lead qualification

NoForm AI’s smart chatbots ask targeted questions to identify high-value leads with genuine insurance needs. This pre-qualifying sales leads saves your insurance agents time and allows them to focus on converting qualified prospects into policyholders.

Trustworthy & focused

NoForm AI uses artificial intelligence to train itself on your website content, enabling it to accurately answer customer questions about your insurance plans and services. This ensures your customers get the right information they need and eliminates confusing or irrelevant conversations.

Secure & compliant

NoForm AI prioritizes data security and complies with industry regulations. You can rest assured that your customer information, including insurance inquiries and personal details, is always protected.

Start growing with a conversational AI-powered chatbot!

Generate qualified insurance leads, improve customer support, and skyrocket sales in the insurance industry with the NoForm AI chatbot. Get started today!

Enter your website link to create your AI chatbot in just 1 minute!

Frequently asked questions

01What is an insurance chatbot?

An insurance chatbot is a virtual assistant powered by AI (artificial intelligence technology) that can converse with customers on your website. Imagine a friendly insurance agent available 24/7 who can answer your customer queries naturally using NLP (natural language processing)—fancy talk for understanding human conversation. This allows for improved customer self-service by providing instant information and support.

02How is AI being used in insurance?

Conversational AI for the insurance industry transforms how customers interact with their insurance companies. Chatbots can answer basic questions about policy details, gather information, and even help file claims. This frees up human agents to focus on more difficult customer requests, leveraging conversational AI technology for complex claim assessment.

03Will AI replace insurance agents?

No, AI is not meant to replace agents entirely. NoForm AI chatbots are designed to work alongside your existing team, acting as a helpful first point of contact to improve response time and customer experience. This allows agents to focus on personalized advice and complex issues, ensuring human intervention where it matters most. By gathering valuable customer information during conversations, NoForm AI enables agents to prioritize qualified leads and close deals faster.

04How is AI used in insurance pricing?

Conversational AI in the insurance sector can analyze vast amounts of data to more accurately assess risk factors like driving history, health records, and property details. This can help insurance companies offer more personalized rates to customers, making updating policy details more streamlined and accurate.

05How is AI transforming the insurance industry?

Conversational AI is transforming the insurance industry by making it faster, more efficient, and more customer-friendly. Chatbots provide 24/7 support, answer basic questions, and streamline processes, ultimately making the insurance industry a more convenient and accessible experience for everyone. Insurance companies can optimize operations and enhance customer service by implementing conversational AI platforms and automation.