AI Banking Chatbot

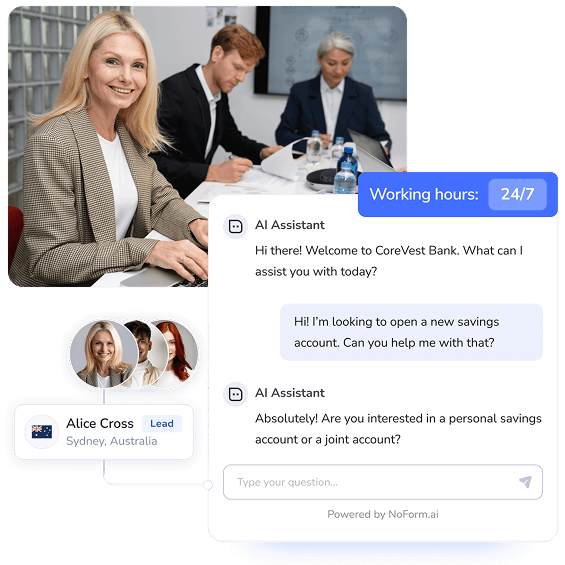

Convert website visitors into qualified leads with a NoForm AI-powered chatbot. Provide exceptional 24/7 customer support, answer common banking questions, and streamline loan application processes to improve customer satisfaction and boost banking services.

Enter your website link to create your AI chatbot in just 1 minute!

Attract more customers, streamline services, and boost loyalty with NoForm AI banking chatbots

Engage potential clients instantly, answer their banking inquiries 24/7, and build trust. Stand out from the competition with NoForm AI chatbots for the banking industry.

Offer 24/7 support & instant answers

78% of customers choose the company that responds first. NoForm AI chatbot solution for banks acts as your virtual assistant, available around the clock to answer account inquiries, assist with loan applications, and provide personalized financial advice. This means satisfied customers and increased loyalty for your bank!

Qualify leads faster with conversation

Don’t lose potential clients to lengthy forms! NoForm AI banking chatbots engage visitors in natural, human-like conversations, guiding them through account options, loan services, or credit inquiries. This lets you qualify leads while they chat, saving you time and resources. Now, you can focus on what matters most—building lasting client relationships!

Boost customer satisfaction and keep them coming back

56% of businesses see conversational chatbots as a game-changer. Why? Because NoForm AI banking chatbots provide accurate answers to FAQs about account services, loan options, and financial planning, offering 24/7 support and enhancing customer satisfaction. Happy clients are more likely to return and recommend your bank, leading to increased customer loyalty and a stronger reputation in the banking industry.

Lead targeted communication, gain valuable insights

NoForm AI personalizes every client interaction, learning about individual financial needs and goals in real-time. Additionally, this AI-powered software analyzes these conversations, providing valuable insights into customer preferences. Use this information to enhance your service strategy, improve client engagement, and offer tailored banking solutions, boosting overall performance.

Increase efficiency, reduce costs

NoForm AI automates time-consuming tasks like answering FAQs about account types and processing loan inquiries. This frees up your banking team to focus on personalized client interactions and financial planning. The result? Improved efficiency, lower operational costs, and happier customers.

Turn your website into a non-stop service center

Automatically qualify the best banking leads based on client needs, offer targeted financial products, upsell additional services, and collect customer feedback directly within your AI chatbot. NoForm AI banking chatbots guide potential clients through their financial inquiries, answer questions, and provide instant support 24/7.

Give your customers the instant support they deserve with NoForm AI banking chatbots!

Boost customer satisfaction and unlock hidden growth potential with NoForm AI, the no-code AI chatbot builder designed for banks.

What Our Customers Say

We were truly stunned at the ease of engagement, setup up, and implementation – in just a few minutes (literally), I had an operational bot on our website, with specifically trained AI that supported qualifying conversations about our business and full integration with a 3rd party scheduling system so people could book a demo with someone on the team. I’m very excited to measure the impact of this on our business as we move forward.

Applied Intelligence Agency

CEO

The fact that a customer can come in and get their questions answered 24/7 is highly critical, especially compared to just reading website information or filling out a form. As an international business dealing with clients all over the world, this accessibility is essential.

Rebecca Henning

We were truly stunned at the ease of engagement, setup up, and implementation – in just a few minutes (literally), I had an operational bot on our website, with specifically trained AI that supported qualifying conversations about our business and full integration with a 3rd party scheduling system so people could book a demo with someone on the team. I’m very excited to measure the impact of this on our business as we move forward.

Applied Intelligence Agency

CEO

The fact that a customer can come in and get their questions answered 24/7 is highly critical, especially compared to just reading website information or filling out a form. As an international business dealing with clients all over the world, this accessibility is essential.

Rebecca Henning

Why NoForm AI is the perfect

banking chatbot system for

your bank!

Don’t miss out on potential clients—let NoForm AI chatbots for banks automate lead capture,

nurture every customer interaction, and help your bank thrive!

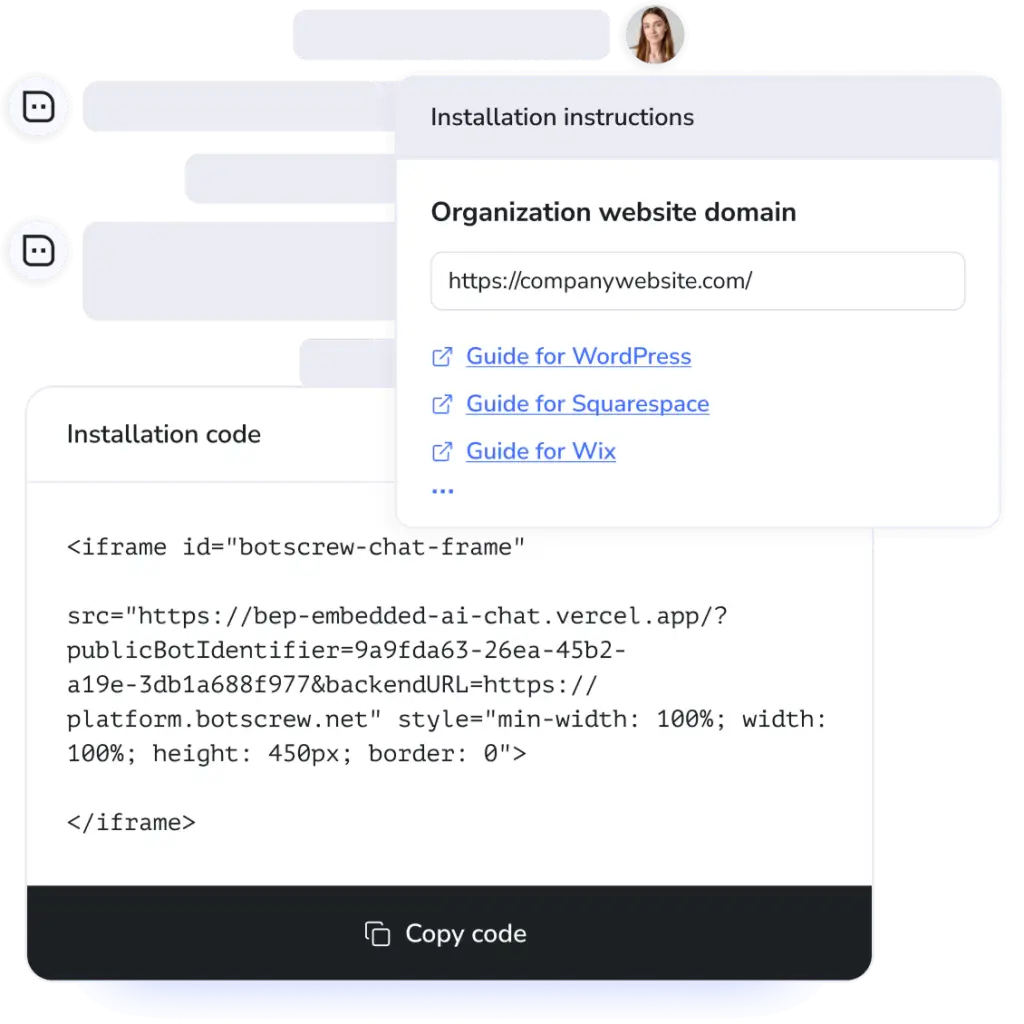

Easy setup & use

NoForm AI is a user-friendly platform that lets anyone create an AI-powered banking chatbot in minutes with a simple installation process and no coding skills required. Just copy and paste an embed code, and you’re ready to provide 24/7 customer support, assist with account inquiries, and guide clients through loan applications.

Seamless integration

NoForm AI integrates smoothly with popular platforms like WordPress, Wix, Squarespace, and more. This ensures a seamless experience for both you and your potential banking clients.

Fully customizable

Customize your chatbot’s look and feel to match your bank’s brand perfectly. Build trust and provide a consistent experience for your website visitors, reflecting the professionalism of your bank and enhancing customer interactions within the banking industry.

AI-powered lead qualification

NoForm AI chatbots gather valuable client information during conversations, such as preferred account types, loan needs, and financial goals. By leveraging advanced banking AI and machine learning, these chatbots can identify serious leads, saving your team time and allowing them to focus on enhancing overall banking services.

Trustworthy & focused

NoForm AI uses artificial intelligence to train itself on your bank’s website content, ensuring it answers banking-related questions accurately. This eliminates confusion and ensures potential clients get the correct information they need.

Secure & compliant

Customer privacy is a top priority. NoForm AI safeguards data and complies with regulations, ensuring customer information, such as contact details and financial inquiries, is always protected, keeping your bank secure and building client confidence.

Start growing with a conversational AI-powered customer engagement chatbot!

Convert website visitors into qualified leads and enhance the overall banking experience with the NoForm AI chatbot. Unlock your bank’s full potential today!

Enter your website link to create your AI chatbot in just 1 minute!

Frequently asked questions

01How do banking chatbots work?

Banking chatbots use artificial intelligence (AI) and natural language processing (NLP) to engage in customer conversations. They can understand and respond to user queries by analyzing the input and generating relevant responses. Using continuous learning algorithms, chatbots improve over time, adapting to new customer queries. This enables the banking AI chatbots to assist customers with their banking needs in real-time, 24/7, enhancing their digital banking experience.

With AI-driven capabilities, chatbots in the financial industry can automate routine processes, saving time for customers and banks, promoting cost savings, and smoothing the banking customer experience.

02What services can banking chatbots offer?

Banking chatbots can offer a wide range of services, including:

- Answering FAQs. Providing quick and accurate information on various banking topics, such as types of bank accounts, loan options, credit cards, and savings accounts, and informing customers about branch locations & ATMs.

- Assisting with loan applications. Guiding customers through the financial product application process and providing personalized recommendations based on their needs.

- Scheduling appointments. Helping customers book appointments with bank representatives for in-person consultations or financial advice.

- Providing personalized financial advice. Offering tailored recommendations based on customer data, such as customer spending habits, credit scores, and financial goals.

These AI chatbots for banks enhance customer interactions and improve overall customer experience in the banking industry.

03Are chatbots in banking secure?

Yes, banking chatbots are designed with security in mind. They use encryption and comply with regulations to protect sensitive customer data. Adopting best practices for security ensures that chatbots for banking protect customer data while providing fast and reliable support.

04Can chatbot technology handle complex customer interactions?

While chatbots excel at handling straightforward inquiries, advanced AI chatbots can manage more complex interactions by using contextual understanding and machine learning. Human intervention may be necessary for highly intricate issues, allowing the chatbot to escalate the conversation to a customer service agent when required.

05Do I need a dedicated development team to build my banking chatbot?

No, you do not necessarily need a dedicated development team. Many banking chatbot platforms, like NoForm AI, offer user-friendly interfaces that allow non-technical users to create and customize chatbots easily without extensive coding knowledge. The chatbot platform’s integration capabilities with existing systems can be implemented efficiently, enabling financial institutions to scale their chatbot service alongside their growth in the digital banking sector.

06How can I be sure an AI chatbot will meet my customers' needs?

To ensure that an AI chatbot for banking meets your customers’ needs, it’s essential to:

- Customize the chatbot. Tailor the chatbot’s responses to match your specific customer base and banking products.

- Gather customer feedback. Regularly collect customer feedback to identify areas for improvement and ensure the chatbot provides valuable assistance.

- Utilize analytics. Analyze customer interactions and chatbot performance to identify trends and optimize the chatbot’s capabilities.

- Continuously learn and improve. Regularly update the chatbot’s knowledge base and train it on new data to ensure it remains accurate and relevant.

By following these guidelines, you can ensure that your banking chatbot is a valuable asset that exceeds customer expectations, delivers personalized customer service, enhances overall customer satisfaction, and drives business growth.